Kia Finance America: Rates, Offers & Loan Guide 2025

Introduction – Why Kia Finance America Matters

Buying a new car is exciting. But one big question comes right after: “How do I pay for it?” Most people don’t buy a car with full cash. Instead, they use financing—loans or leases that spread the cost over months or years.

For Kia buyers in the United States, the main choice is kia finance america (KFA). This is the official finance company that helps you get a loan, lease, or payment plan when you buy a Kia.

In this guide, we will explain:

- What Kia Finance America is.

- How it works, step by step.

- The rates, offers, and special deals you can get.

- The pros and cons of using it.

- Tips to save money and avoid mistakes.

- Alternatives you should also consider.

By the end, you will know everything you need to make the best choice for your next Kia car.

2. What is Kia Finance America?

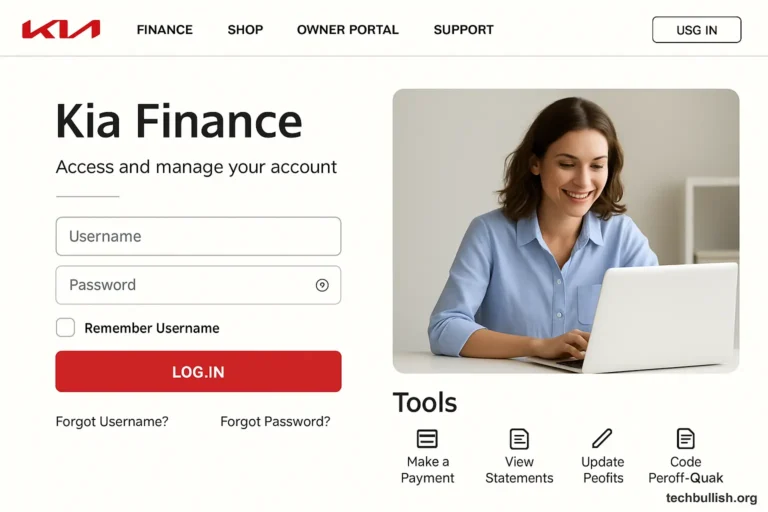

Kia Finance America (KFA) is the U.S. financing branch for Kia Motors. It helps customers:

- Apply for a car loan.

- Sign a lease agreement.

- Make online payments.

- Check their statements.

- Manage your account 24/7 through the Kia Owners Portal.

Behind the scenes, Kia Finance America is powered by Hyundai Capital America, which handles financing for both Kia and Hyundai cars. This means it has strong financial backing and works with Kia dealers across the U.S.

In short: If you’re buying or leasing a Kia in America, Kia Finance America is the main way to handle your loan or lease.

3. How Kia Finance America Works – Step by Step

Let’s break down the process into simple steps:

Step 1: Pre-Approval

You can start by filling out an online credit application on Kia’s website. This checks your credit score and tells you if you qualify.

Step 2: Dealer Visit

When you go to a Kia dealer, you can apply for Kia Finance America directly. The dealer will connect your loan or lease request with KFA.

Step 3: Verification

Sometimes, KFA asks for a “welcome interview” or phone call to confirm your details. Don’t worry—it’s a security step.

Step 4: Loan or Lease Setup

Once approved, your loan or lease begins. You will receive your monthly payment amount, due date, and login details for online account management.

Step 5: Monthly Payments

You can make payments online, by mail, or even set up autopay. Through your account, you can also:

- View your statements.

- Check your FICO credit score.

- Set alerts for payment reminders.

4. Kia Finance America rates, terms, and special offers.

One of the main reasons people choose Kia Finance America is for the special rates and offers.

Typical Loan Terms

- 36, 48, 60, or 72-month loan terms are common.

- The longer the term, the lower the monthly payment—but you may pay more in interest.

Interest Rates (APR)

- Kia sometimes offers 0% APR or very low APR deals on certain models.

- For example, during seasonal sales, you might see 0% APR for 60 months or 1.9% APR for 48 months.

Lease Deals

- Kia also offers lease specials with low monthly payments.

- Some deals even start at $199 per month with a down payment.

Incentives

- Cash rebates for certain models.

- Military discounts.

- College graduate programs.

- Loyalty rewards for existing Kia customers.

👉 Pro Tip: Always check Kia’s official offers page or ask your dealer about current Kia Finance promotions before signing.

5. Pros and Cons of Kia Finance America

Like every finance option, Kia Finance America has good sides and downsides.

✅ Pros

- Direct connection with Kia dealers.

- Easy account management is available online.

- Access to special APR and rebate offers.

- Free FICO credit score monitoring.

- Simple setup compared to third-party lenders.

❌ Cons

- Limited flexibility compared to banks or credit unions.

- Some customers report delays in account setup.

- Legal issues in the past with the repossession of military members’ vehicles.

- Not always the lowest APR if your credit is very strong.

6. Real Customer Stories – The Good and the Bad

To understand Kia Finance America better, let’s look at what real customers say.

- Positive Story: Many customers love the 0% APR deals, saying they have saved thousands in interest.

- Negative Story: Some Reddit users complained about a required verification phone call that delayed their loan approval.

- Legal Issue: In 2024, Kia Finance America faced lawsuits for allegedly repossessing the vehicles of U.S. service members without following the law. This is a reminder to always read the fine print.

👉 Lesson: Kia Finance America works well for many people, but always check the terms carefully before signing.

7. Tips to Get the Best Deal with Kia Finance America

Here are smart ways to save money and avoid common mistakes:

- Check Your Credit Score First – The better your score, the lower your APR. Use Kia’s FICO Insight tool to keep track.

- Time Your Sale – Kia often has special promotions around holidays or end-of-year sales.

- Negotiate the car price separately – don’t let the dealer distract you with monthly payments. First, agree on the car price; then talk about financing.

- Compare with other lenders – even if you like Kia Finance, ask your local credit union or bank for their rates, too.

- Set Up Auto-Pay – This avoids late fees and helps to improve your credit.

- Understand Lease vs. Finance – Leasing might be cheaper monthly, but you don’t own the car. Financing means higher payments but full ownership.

8. Alternatives to Kia Finance America

While KFA is convenient, it’s not your only choice. Here are some alternatives:

- Banks (Chase, Wells Fargo, etc.) – They may offer competitive APRs for top credit.

- Credit unions often have lower rates than banks or dealers.

- Online Auto Loan Providers – Quick approval and pre-qualification.

- Cash or Personal Loan – If you want to avoid car financing altogether.

👉 Smart buyers compare at least three financing offers before choosing.

9. FAQs – Common Questions About Kia Finance America

Q1. Can I pay off my Kia Finance loan early? Yes, you can. Most Kia Finance loans have no penalty for early payoff.

Q2. What happens if I miss a payment? You may face late fees, and your credit score could drop. Always contact Kia Finance immediately if you can’t pay.

Q3. Is there a penalty for early lease return? Yes, you may face early termination fees. Read your lease contract carefully.

Q4. Can I refinance my Kia loan with another lender? Yes. Many customers refinance with banks or credit unions if they find a lower APR later.

Q5. How do I contact Kia Finance America? You can log in at kiafinance.com or call their customer service.

10. Conclusion – Is Kia Finance America right for you?

Kia Finance America is a solid choice for anyone buying or leasing a Kia in the U.S. It offers:

- Easy setup with Kia dealers.

- Special promotions, like 0% APR, are available.

- Online account tools and FICO score insights.

But remember:

- Always compare with banks or credit unions.

- Read the fine print to avoid surprises.

- Use promotions wisely to save money.

🚗 Final Word: If you’re planning to buy a Kia, Kia Finance America is worth considering. But the smartest buyers always shop around before signing on the dotted line.