Kia Finance 2025 Guide: Payment Options & Easy Plans

1. What does Kia Finance mean?

Kia Finance offers flexible and easy payment solutions for Kia car buyers. Whether you want a new or certified pre-owned vehicle, this guide explains how Kia Finance works, what plans are available in 2025, and how to manage your payments smartly.

- It includes car loans, installment plans, and Shariah-compliant financing such as car ijarah. Sometimes, there are interest-free or low-interest offers, too.

- The aim is to spread the cost of the vehicle over time so that you can drive it now and pay later.

Why do people choose financing?

- It reduces the immediate cash burden.

- It allows people to buy more expensive or higher-trim cars than they might be able to afford with cash.

- Sometimes financing options come with special offers, like low interest or zero interest.

There are trade-offs. You will pay more over time because of interest. Plus, you might need to make a big down payment.

2. Types of Kia Financing Plans

Here are common types of financing plans for Kia vehicles in other countries. The exact names and conditions differ by country, bank, and dealer.

TypeKey Features

- Traditional Auto Loan / Installment Plan: You borrow money and pay it back each month. This continues for a specific time and includes interest.

- Islamic / Shariah-Compliant Financing (Car Ijarah / Lease-to-Own): This option avoids interest (riba).

The bank or financing company owns the vehicle and leases it to you. They transfer ownership at the end or over time.

Interest-Free Plans: You pay the cost of the car in installments with no markup (interest).

- Usually, it requires a large down payment or shorter fixed periods.

- Zero or low APR (Annual Percentage Rate) offers.

- Special promotions from Kia or partner banks.

- Means low extra cost.

- Balloon / Residual Payments: Some plans have a large last payment, known as a balloon, or a residual value.

- Lease vs. Sale: Leasing lets you use the car, and you return it later. Purchasing means you own it.

Leasing is sometimes cheaper monthly, but there is no ownership at the end.

3. Kia Finance in Pakistan – Latest Offers and Deals

Since you are likely to be in Pakistan, here are recent offers and typical examples (as of mid-2025). Always confirm with Kia dealers or banks because offers change.

- Kia’s Ramadan Installment Offers:Kia and Habib Metro Bank have a Sharia-compliant financing plan for Ramadan. For example, Kia EV5 models have monthly payments starting from PKR 128,854 at a fixed interest of 1% over KIBOR + 1%. Down payments are large (e.g., PKR 15,540,000 for the EV5 Air). ProPakistani.

- Meezan Car Ijarah lets you lease the Kia Sportage L in a Shariah-compliant way. You can choose a lease term of up to 3 years and make monthly payments. This is a bank-car partnership: Auto Power.

- Sportage Interest-Free Installment Plans: Kia introduced an 18-month interest-free plan on all variants of Sportage (Alpha, FWD, AWD, Limited Edition) with large down payments. ProPakistani+1

- EMI Plan for Sorento 3.5L V6: For the top model Sorento 3.5L V6, Kia offers an EMI plan. You pay around 30% as a down payment. You can pay the rest over five years. Monthly payments start at around Rs 246,801. This amount varies based on the down payment and the variant. pkrevenue.com

- Financing for the Picanto and other models:

- UBL Drive scheme for Picanto 1.0 AT: monthly fixed and residual payments. Example: down payment, price, etc. ProPakistani

- Offers from Askari Bank: Get a Picanto with monthly payments of around Rs 65,216. You can save about Rs 137,087.

- Fixed-Rate Offers: Meezan Bank’s Car Ijarah for the Sportage and Sorento has a fixed annual rate of 7.99%. This rate applies to terms ranging from 1 to 3 years. This offer includes insurance and more. Kia Motors South.

- Price Lock Offers: Kia Pakistan has launched “price lock” offers. This allows buyers to fix the current price of a model, even with a partial payment. Validity until certain dates.

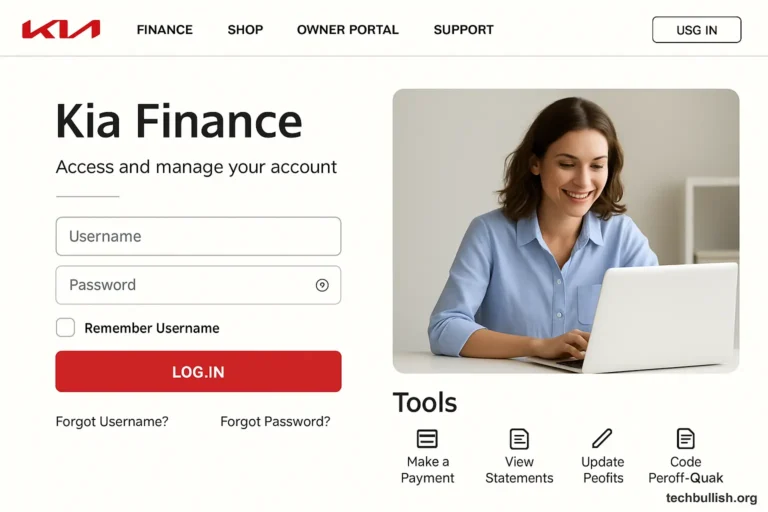

4. How to Apply for Kia Financing

Here’s a step-by-step plan to apply for Kia Finance:

- Choose your Kia model (like the Picanto, Sportage, Sorento, or EVs). Then, check the specs and price.

- Check current promotions or offers. Visit Kia Pakistan or dealer websites. Check bank offers for interest-free, Shariah-compliant, or special APR options.

- Calculate how much you can afford.

- Down payment: Many offers need 20-30% or more upfront.

- Monthly installment: an amount you can pay without strain.

- Total cost over the period, including interest/markup.

- Choose a financing type. If Shariah-compliant is important, pick those options. Choose the tenure, usually between 1 and 5 years. Then, decide if you want a residual or balloon payment.

- Gather documents.

- Proof of income (salary slips, bank statements)

- CNIC

- Proof of house.

- Sometimes, lenders consider previous loan history (credit).

- Apply via bank or dealer. Many dealers have tied banks. You can go to a bank on your own. Fill out the application and submit documents.

- Get approval and sign the contract.

- Examine the contract with attention to detail.

- Check the interest or markup rate.

- Look for penalties.

- Review the payment schedule.

- Know what happens if you miss payments.

- Make a down payment and start the installments.

5. What Costs and Terms to Watch Out For

When financing a car, many costs and terms can raise your expenses or lead to issues later. Here are the main ones:

Term / Cost What to Know Interest or Markup Rate This is what you pay extra. Lower is better. In some offers, they fix it; in others, they tie it to KIBOR as a variable. A down payment is often required.

Pay more upfront, and your monthly payments will be lower.

Tenure: The number of months or years you have paid for.

Longer tenure means lower monthly payments, but total interest goes up.

Residual / Balloon Payment: Some plans must have a large payment at the end.

- Plan: Always consider administration and processing fees. This includes dealer fees, paperwork, insurance, registration, and taxes. Always ask about these costs.

- Insurance / Takaful: Many plans need insurance, so its cost is important.

- Withholding Tax (WHT): In Pakistan, WHT applies to some financial transactions. Being a WHT filer can affect your rate.

- Late Payment Penalty: Know what happens if you delay or miss a payment.

- Ownership Transfer / Title: In Shariah / Ijarah, the financing company keeps the title. The borrower receives it after the final payment.

Recognize the moment you gain legal ownership.

6. Financing vs. Leasing – Which is best?

Option Pros

- You will own the car completely after making the last payment.

Cons

- Payments can add up over time.

Financing / Buying via Installments

No return condition. Long-term, it’s cheaper if you keep the car for many years. Higher monthly payments. You bear maintenance and depreciation—more upfront cost. Leasing / Ijarah / Shariah-Lease sometimes has lower monthly payments. Flexible terms. If you like changing cars often, it might work. Shariah options avoid interest. It doesn’t build ownership until the end. Likely more restrictions (mileage, condition). It could cost more over the very long term.

7. Tips to Save Money When Financing a Kia

These small strategies can have a big effect on what you pay.

- Look for special promotions, such as: Zero or low interest . Interest-free plansFixed-rate offer, deals. E.g., Kia’s Ramadan or seasonal offers.

- Be a WHT filer (in Pakistan) – being a filer may reduce your taxes/charges.

- Negotiate the down payment or its structure. If you can pay more upfront, your installments will be lower.

- Shorter tenure, if you can afford higher monthly payments, reduces total interest.

- Choose a reliable used bank or dealer with transparent fees—no “hidden” charges.

- Examine the residual or balloon payment with attention to detail. This way, you can avoid surprises.

- Keep credit good – better credit or financial standing often leads to better rates.

- Check offers from various banks. Bank financing can differ greatly from in-house or brand financing.

8. Common Questions (FAQs)

Q. What credit score or history do I need? A. It depends on the bank or finance company. In Pakistan, banks check proof of income, credit history, and past loans. Good credit helps you get better rates.

Q. What is Shariah-compliant financing or Ijarah? A. It is a financing method that complies with Islamic law. You rent or lease the vehicle instead of paying interest. Once you meet the terms, you transfer ownership.

Q. Can I refinance or change my financing plan later? A. Sometimes yes, if your credit improves or market rates drop. But refinancing may come with fees. Also, interest-free or Shariah plans may not allow changes or may alter compliance.

Q. What happens if I miss a payment? A. Usually, there are penalties.

- Possible late fees

- Loss of special offer (if the plan has specific conditions).

- In the worst case, repossession (depending on the contract) occurs.

Read the contract.

Not possible to remove the adverb. A. Both have advantages. Dealership-tied financing may offer special promotions from Kia. Banks might offer more flexibility or better rates if you have good credit. Compare both.

9. Summary

Financing a Kia car is a smart way to spread the cost, get a newer or higher-spec model, and manage your budget. Be careful. Read the fine print. Understand all fees. Choose an offer that fits your budget, and seek transparency.

If you are in Pakistan:

- Watch out for interest-free plans (they’re rare and special).

- Shariah-compliant Ijarah finance is a major option.

- Promotions, like seasonal sales or bank partnerships, can greatly lower costs.

- Factor in the down payment, insurance, registration, taxes, etc.

Before you sign anything, first calculate the total cost. Check what you will own in the end. If you follow good habits, you can get a Kia with terms that are fair, manageable, and cost-efficient.